Home Insurance Calculator

Your home is one of the biggest investments you’ll ever make. Whether you own a cozy condo, a family house, or a townhouse, protecting it with the right home insurance is essential. But here’s the problem: home insurance costs vary a lot.

That’s where a home insurance calculator comes in. It’s a free tool that gives you a personalized estimate of how much you might pay for coverage—before you even start requesting quotes.

Think of it like a test drive. You’re not locked into a number, but you’ll get a good idea of what to expect, what affects your price, and how you can save money.

What Is a Home Insurance Calculator?

A home insurance calculator is a tool that helps you estimate the cost of insuring your home. It uses information about your property, location, and personal details to give you a price range for coverage.

It’s important to know:

The calculator gives you an estimate, not an exact premium.

Insurance companies may calculate slightly differently.

But it’s still a smart way to plan your budget and compare options.

How Does a Home Insurance Calculator Work?

The calculator uses a mix of your inputs + risk factors to estimate cost. Here’s how it works in plain language:

You enter your home details (size, type, age, location).

You choose the coverage amount (basic, full, or custom).

The tool checks risk factors like crime rates, weather, and property value in your area.

It calculates a monthly and yearly estimate for your premium.

That’s it! In less than 5 minutes, you’ll see what you might pay and what’s driving that cost.

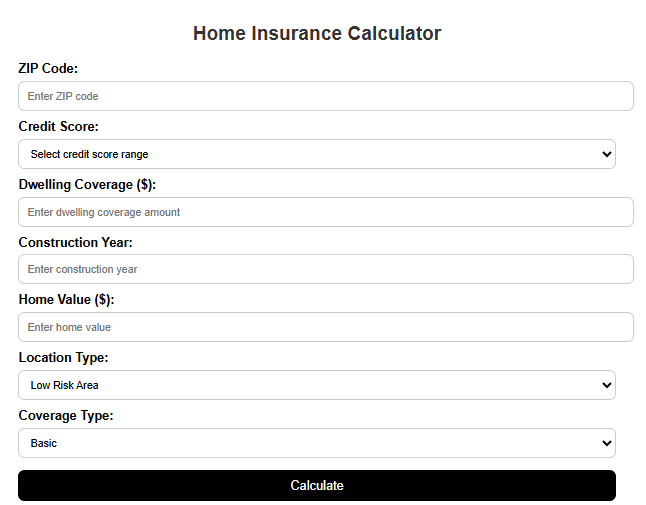

Step-by-Step Guide: How to Use Our Calculator

Enter Your Basic Info

Start with your ZIP code, age, and gender.Add Your Vehicle Details

Input your car’s make, model, year, and condition.Pick Your Coverage Type

Minimum coverage (cheapest, basic protection)

Full coverage (liability + collision + comprehensive)

Custom coverage (choose what fits your needs)

Provide Driving & Personal Details

Driving record (accidents, tickets)

Annual mileage (less driving = lower cost)

Credit score (in some states, this affects your rate)

View Your Estimate

You’ll see a monthly and yearly cost range. Use this as a starting point before requesting real quotes.

Step-by-Step Guide: How to Use a Home Insurance Calculator

Let’s break it down in simple steps:

1. Enter Your Home’s Location

Add your ZIP code.

Why it matters: insurance costs vary a lot by location. A coastal Florida home will cost more to insure than one in suburban Ohio.

2. Add Your Property Details

Type of home (single-family, condo, townhouse).

Size in square feet.

Year built and current condition.

Extra features (garage, swimming pool, fireplace).

👉 Tip: The more details you enter, the more accurate your estimate will be.

3. Enter the Value of Your Home & Belongings

Estimate your home’s replacement cost (not the market value).

Include the value of personal property (furniture, electronics, clothing).

👉 Example: If your home is worth $250,000 to rebuild and you have $50,000 in belongings, your calculator will factor in both.

4. Choose Your Coverage Options

Dwelling Coverage – Protects your house structure.

Personal Property Coverage – Covers belongings inside.

Liability Coverage – If someone gets hurt on your property.

Additional Living Expenses – Pays if you need to live elsewhere after damage.

👉 Example: If you want higher liability protection (say $300,000 instead of $100,000), your cost will rise.

5. Add Risk & Personal Info

Safety features (alarm system, fire sprinklers, smoke detectors).

Claims history (previous insurance claims).

Credit score (in many states, better credit = lower rates).

6. View Your Estimate

The calculator gives you a monthly and yearly price range. This helps you decide whether your budget matches the coverage you want.

What Factors Affect Your Home Insurance Estimate?

Here’s a closer look at what drives your costs up—or down.

1. Location

High-risk weather zones (hurricanes, floods, wildfires) = higher cost.

Urban areas with higher crime rates = higher cost.

Rural or safe areas = lower cost.

2. Home Value & Size

Larger homes = more to rebuild, so more coverage needed.

Luxury homes = higher premiums.

Smaller, modest homes = lower costs.

3. Age & Condition

Older homes may have outdated wiring or plumbing → higher risk.

Newer homes built to modern codes may save you money.

4. Coverage Level

Minimum coverage = lowest cost but least protection.

Standard coverage = good balance.

High coverage = more cost, but full peace of mind.

5. Safety Features

Security systems, smoke detectors, fire alarms = discounts.

No safety features = higher premiums.

6. Personal Factors

Claims history → If you’ve filed many claims, your cost may rise.

Credit score → Good credit often lowers premiums.

Real-Life Examples

Example 1: Suburban Family Home

Location: Texas, suburban ZIP

Size: 2,000 sq. ft, built in 2015

Coverage: Full coverage

Estimate: Around $1,600/year

Example 2: Coastal Home in Florida

Location: Near beach, hurricane-prone area

Size: 1,800 sq. ft, built in 1980

Coverage: Full coverage with flood insurance

Estimate: Around $2,800/year

Example 3: Condo in New York

Location: Manhattan

Size: 900 sq. ft condo

Coverage: Dwelling + liability

Estimate: Around $1,200/year

👉 These show how location and property details make a big difference.

How to Lower Your Estimated Cost

Bundle policies – Combine home and auto insurance for discounts.

Improve safety – Add alarms, locks, and sprinklers.

Raise your deductible – Higher deductible = lower monthly premium.

Maintain good credit – In most states, better credit = better rates.

Shop around – Always compare at least 3–5 quotes.

What to Do After Using the Calculator

Review your estimate and see if it fits your budget.

Compare quotes from different insurance providers.

Ask about discounts (bundle, claim-free, senior, or safety discounts).

Adjust coverage – Don’t under-insure just to save a little money.

Review yearly – Life changes = different insurance needs.

Final Thoughts

Using a home insurance calculator is the easiest way to estimate your costs before shopping for quotes. It shows you what matters, what affects your price, and how you can save money without sacrificing protection.

💡 With ZeroGrok, you can take the next step—get personalized quotes, compare plans side by side, and uncover discounts that calculators don’t always show.

👉 Try the calculator today and protect your home with confidence.